Life Insurance in Spain: How does it works?

Yohan Leuthold2025-03-05T10:53:08+00:00Index

ToggleLife Insurance in Spain: How does it work?

You are the head of the family and want to guarantee the future of your loved ones ... You want to protect yourself against a disability that can affect your daily life ... You must insure the payment of your mortgaged house ... There are many situations as subscribing to life insurance can address.

What is life insurance?

Life insurance is a contract by which the insured, in return for the payment of premiums, covers his person and any other dependent on him, against risks of disability and death.

There are different types of contracts, but the main ones are:

- Term life insurance: a periodic premium is paid to have a guaranteed capital in the event of death or disability. The renewal of the contract is annual and the premium increases according to the age of the insured.

- Decreasing term (or level premium) life insurance: a constant premium is paid for a defined period of time. This insurance is widely used in case you want to guarantee the payment of a mortgage.

How does the tax system work in Spain?

The taxation of life insurance depends on two factors:

- Who receives the benefits: Policyholder or Beneficiary

- How are perceived the benefits: In the form of capital or annuity

Service received by the policyholder

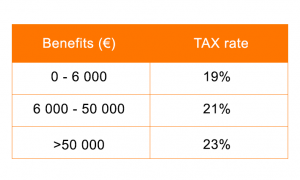

If the benefit is received by the policyholder, it will be considered as capital gains (Rendimientos del capital mobiliario RCM) subjected to a tax which can be 19% to 23%.

The three-slice scale breaks down as follows:

- If the benefit is received in the form of capital , the income obtained will be determined by the difference between the capital received and the premiums paid.

- If the benefit is received in the form of an annuity, different reduction coefficients will be applied to income depending on the duration of the annuity.

Benefit received by the beneficiary

If the benefit is received by the beneficiary, it will be subject to tax on inheritance and donations (Impuesto de Sucesiones y Donaciones ISD) which varies according to each Spanish autonomous community.

Why is life insurance so important?

Life insurance is probably the most important insurance we have to buy. Even if it is not compulsory like car insurance or as widespread as home insurance, it is the only one that directly covers you and your family. This protection allows you to guarantee the education of your children, to maintain your standard of living, but also to guarantee the continuity of your business if one of the key person can no longer work… there are many reasons and different possibilities for the same idea: cover the person .

To find out more about life insurance and receive a quote , don't hesitate to contact us. We will be able to answer all your questions and present you the solutions adapted to your needs

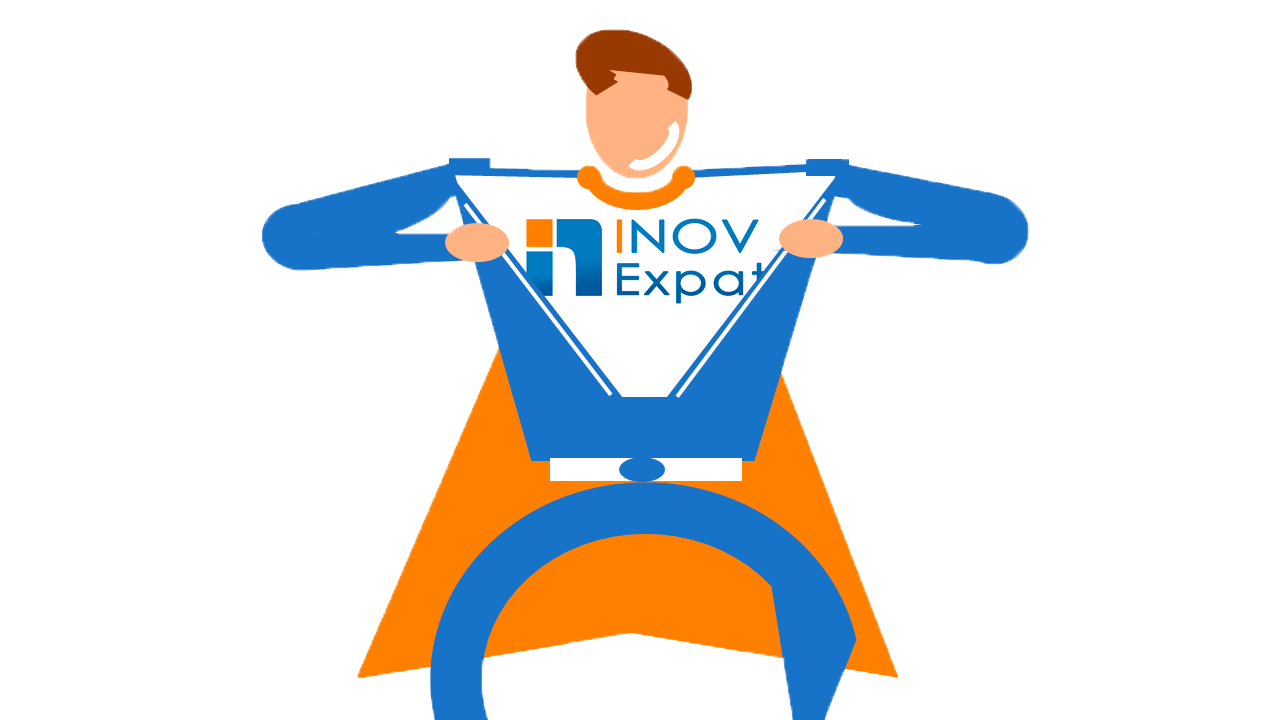

Inov Expat : Who are we?

INOV Expat is an insurance brokerage firm aimed at expatriates in Spain and Portugal

INOV Expat is right there to help you: giving you the best advice on insurance, in English!

In fact, after 14 years, INOV Expat, an insurance brokerage firm, specialises in insurance for French and English-speaking expatriates in Spain and Portugal, at their destinations. We are based in Barcelona, Madrid and Lisbone. As insurance professionals, we’ve signed partnership agreements with the best insurance companies in the market. We collaborate with more than 20 companies so we can compare for you to find the best solution. All INOV Expat consultants are expatriates who will be able to advise you best in the language of your choice (English, French, Russian, Spanish, Portuguese…)

Ask you free quote online : car, health, home, life, travel, others. Look at our website inovexpat.com or contact us by e-mail at [email protected], by telephone at +34.93.268.87.42 or whatsApp +34.627.627.880